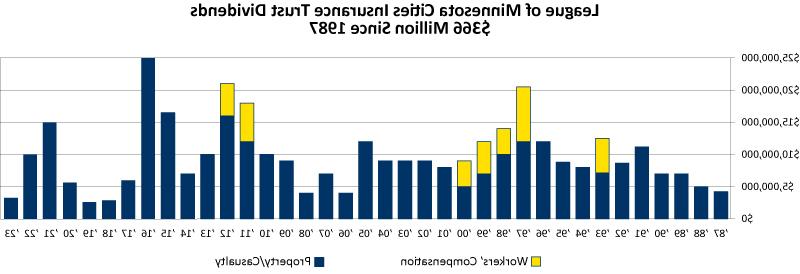

The property/casualty program returned a $3 million dividend to members for 2023. Checks were mailed on Dec. 7, 2023.

Key elements of the dividend formula:

- Dividends are distributed to cities and other entities that are members as of Dec. 1 in the year the dividend is being returned. Former participants do not share in the dividend distributions.

- Each member’s share is proportionate to the difference between the member’s total premiums and total losses as of May 31 for the past 20 years.

- Individual losses are capped at the lesser of $200,000 or 200% of the member’s annual premium for the year of the loss.

Can members expect a dividend every year?

Members should not include dividend returns in their yearly budget projections, since the amount fluctuates year-to-year based on losses experienced by members, actuarial projections, investment results, legislative and coverage changes, reinsurance costs, and the Trust’s long-term strategic direction. The amount of a given year’s dividend return has no bearing on the amount returned the following year, and it’s possible there will be no dividend returned.

Running an organization like the Trust involves inherent unpredictability with respect to the cost of future claims. That’s why the Trust, like all insurers and self-insurance pools, maintains a fund balance as a cushion, which has been built and maintained over time through premiums and investment income.

On occasion, that fund balance can grow beyond the amount needed to be confident the Trust can pay current and future claims and expenses. When that occurs, the Board of Trustees develops a plan to use those excess funds on behalf of the membership.

For many years, one use has been to pay dividends to members. Recently, however, the Trustees have discussed how to use excess funds in the future including options such as dividends, investments in other programs and services, and other ways of serving members. An important part of their evaluation is learning more about how our members view the Trust’s current approach and hearing their suggestions about the best approaches going forward.

We encourage members to contact Operations Manager Laura Honeck at [email protected] or (651) 281-1280 to share feedback about the Trust’s dividend program and whether there are other ways the Trust should consider using excess funds.